By Capital Funding Financial

If you are looking to invest in real estate, protecting your assets is just as critical as finding the right property. One of the most powerful tools in an investor’s arsenal is the Single Purpose Entity (SPE). While often viewed as a mere formality, the SPE is actually a sophisticated shield that protects your wealth and is frequently a requirement when securing financing from private lenders like Capital Funding Financial.

As we navigate the regulatory and legal landscape of 2025, understanding the SPE is more important than ever. From new Supreme Court rulings to federal transparency laws, here is everything you need to know about optimizing your real estate portfolio using Single Purpose Entities.

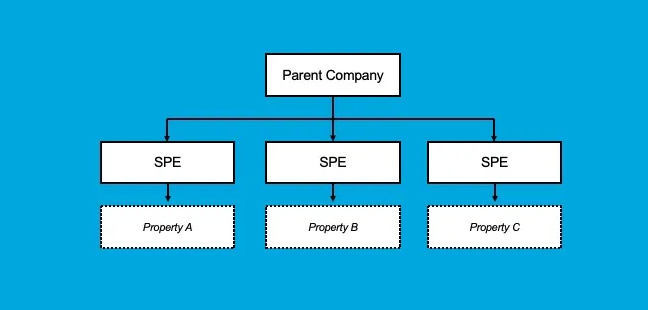

A Single Purpose Entity (SPE)—sometimes called a Special Purpose Vehicle (SPV)—is a distinct legal entity created for one specific objective: to own and operate a single piece of real estate. Unlike a general-purpose business that might hold multiple assets or run various operations, an SPE is designed to be a “silo.”

The defining characteristic of an SPE is that it holds title to the real estate collateral and operates no other business. It effectively isolates the asset, ensuring that the risks associated with one property do not contaminate your other investments or your personal wealth.

When you approach a lender for a commercial loan, they are underwriting the property, not your entire business empire. Lenders require borrowers to form an SPE to make the asset “bankruptcy remote.”

This doesn’t mean the entity can’t go bankrupt; it means the entity is insulated from the financial distress of its owners or affiliates. If you own ten properties in ten separate SPEs and one fails, the other nine—and the lender’s collateral—remain safe from the fallout.

For a lender like Capital Funding Financial, this structure is used for risk management. It ensures that if a borrower faces personal bankruptcy, the property held in the SPE is not immediately dragged into the legal quagmire, allowing the lender to maintain their security interest in the collateral.

The landscape for SPEs has evolved significantly in recent years. Two major developments have reshaped how investors must view these entities.

In 2025, the U.S. Supreme Court delivered a landmark ruling in Dewberry Group, Inc. v. Dewberry Engineers Inc. that reinforced the doctrine of corporate separateness. The Court ruled that a judgment against a parent company or management group could not automatically seize the profits of affiliated SPEs unless the “corporate veil” was formally pierced.1

What this means for you: If you properly structure your portfolio with distinct SPEs for each asset, your protection against affiliate liability is stronger than ever. The “Dewberry Defense” confirms that your assets can remain siloed, provided you respect corporate formalities.

Gone are the days of anonymous shell companies. Effective January 1, 2024, the Corporate Transparency Act requires nearly all real estate LLCs (which typically have no employees) to report their “Beneficial Owners” to the Financial Crimes Enforcement Network (FinCEN).2

Compliance Alert: If you form a new SPE for a transaction with Capital Funding Financial, you must file your Beneficial Ownership Information (BOI) report within 30 days (as of 2025 regulations) to avoid steep federal penalties.3

To satisfy sophisticated lending requirements, a basic LLC Operating Agreement is often insufficient. Lenders may require specific provisions to ensure the entity remains truly separate.

For larger loan amounts, lenders often require the appointment of an Independent Director or Independent Manager. This is a neutral third party whose vote is required for the SPE to file a voluntary bankruptcy petition. Their fiduciary duty is to the entity itself, preventing a borrower from filing a frivolous bankruptcy just to stall a foreclosure.4

What happens if the sole member of an LLC dies? In many states, the LLC dissolves, creating a legal nightmare for the lender.

To prevent this, we utilize a “Springing Member.” This is a person who has no economic interest in the deal but “springs” into place as a Special Member solely to keep the LLC alive if the original owner dies or becomes incapacitated. Florida’s Revised LLC Act specifically authorizes this structure, making it a powerful tool for continuity.5

While many investors default to Delaware due to its robust Court of Chancery, Florida is increasingly becoming the jurisdiction of choice for local real estate investors.

If you are preparing for a closing with Capital Funding Financial, here is the streamlined process to get your entity ready:

Using a Single Purpose Entity is not just a hoop to jump through; it is a strategic foundation that protects your wealth and enhances your borrowability. By isolating risks and adhering to modern compliance standards like the CTA, you ensure that your real estate empire is built on bedrock, not sand.

At Capital Funding Financial, we specialize in asset-based private lending that respects the speed and complexity of the modern market. Whether you need a bridge loan for a luxury flip or financing for a commercial acquisition, we understand the nuances of SPE structuring to get your deal across the finish line.

Ready to fund your next deal? Visit https://capitalfunding.com to learn more about our hard money and private lending solutions.