Mortgage Note Investing 101: The Ultimate Guide to Generating Passive Income Secured by Real Estate

Written By: Dalton DiNatale

Imagine earning consistent, high-yield passive income backed by real estate—without ever having to manage tenants, deal with property repairs, or worry about economic downturns wiping out your equity. This is the distinct advantage of mortgage note investing, a strategy traditionally used by large institutions like banks, hedge funds, and high-net-worth investors to generate predictable cash flow while preserving capital through collateralized debt ownership.

In mortgage note investing, you effectively become the bank. Instead of owning the physical property, you own the mortgage note—the legal debt instrument that gives you the right to receive payments with interest from the borrower. In this in-depth guide, you’ll discover exactly how buying mortgage notes works and why they stand out as one of the most secure and profitable real estate investment avenues available today.

What is Mortgage Note Investing and How Does it Work?

Mortgage note investing is the process of purchasing the debt and payment stream associated with a mortgage loan, rather than buying the tangible property itself. It’s a key strategy in real estate investing focused on debt acquisition.

When a borrower secures a mortgage, they sign two foundational documents:

Mortgage note investors acquire that promissory note, stepping into the role of the original lender. They now possess the legal rights to the monthly principal and interest payments made by the borrower. Because most notes are amortized, the investor consistently recovers their initial capital while generating positive cash flow.

The Benefit of Being the Bank:

This investment is inherently passive: you do not deal with property upkeep, vacancies, or repairs. Furthermore, if the borrower stops paying, the investor has the right to recover the asset through foreclosure—providing a crucial layer of downside protection that is unique among many other investment classes.

In the simplest terms, mortgage note investing allows investors to earn highly secured passive income without the operational headaches of property management. It emphasizes cash flow and capital preservation over speculation on property appreciation.

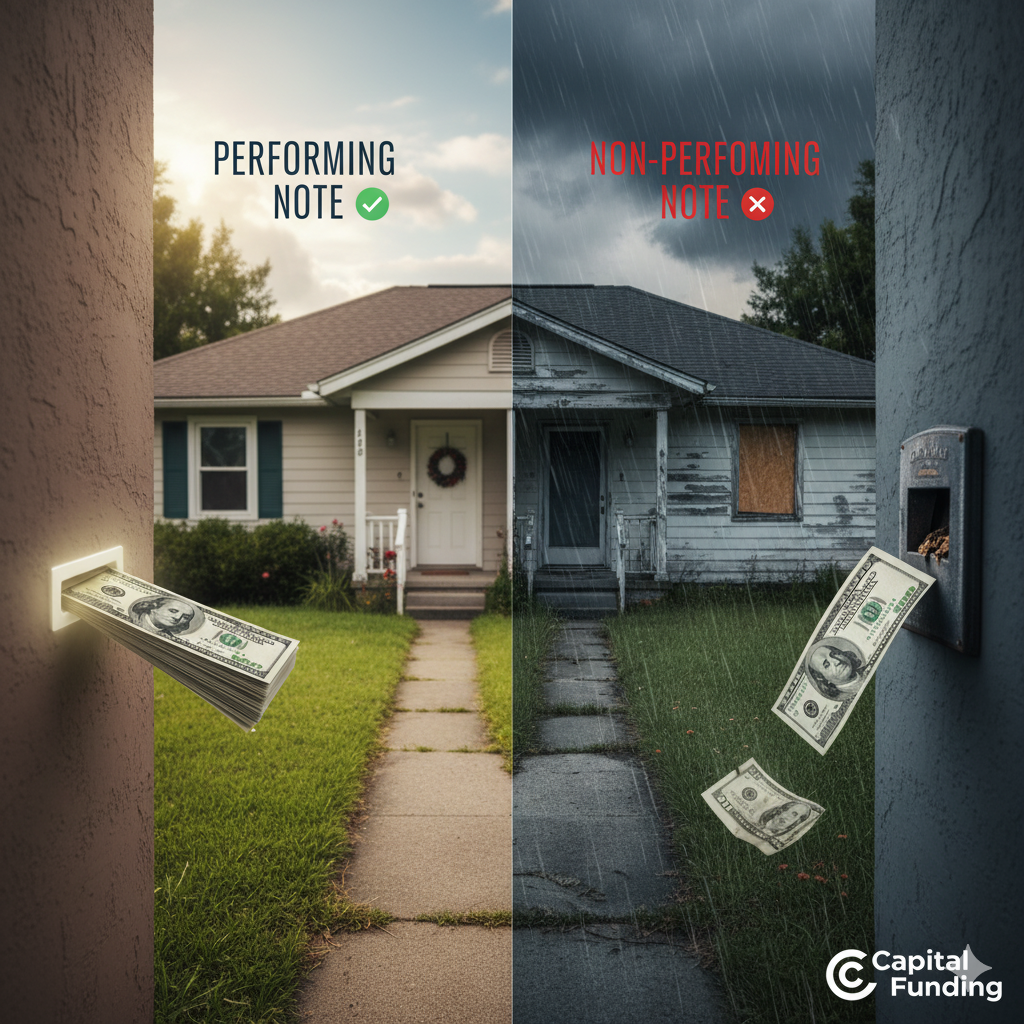

Types of Mortgage Notes: Performing vs. Non-Performing

Mortgage note investing offers flexibility to align with different risk tolerances and investment goals. Understanding the difference between note types is essential for successful portfolio strategy.

Performing Mortgage Notes (PNs)

Performing notes are loans where the borrower is making all payments on time and according to the agreed schedule.

Non-Performing Mortgage Notes (NPNs)

Non-performing notes (NPNs or distressed notes) are loans where the borrower has fallen significantly behind on payments (typically 90+ days delinquent).

Residential vs. Commercial Notes

Notes can be secured by residential properties (homes, condos) or commercial properties (offices, retail).

The 5-Step Process: How Note Investing Generates Cash Flow

Mortgage note investing follows a clear, passive process. Unlike buying a rental property, which is operational, note investing is primarily a structured financial transaction focused on acquiring an income stream.

|

Step |

Description |

Investor Role |

Potential Returns |

|

1. Sourcing |

Notes are acquired from banks, private lenders, or note platforms. |

Choose note type based on risk tolerance (e.g., Performing vs. NPN). |

Higher discounts = higher potential yield. |

|

2. Due Diligence |

Analyze the borrower, collateral, payment history, and legal documents. |

Crucial review of LTV (Loan-to-Value) and property value. |

Ensures investment safety and mitigates risk. |

|

3. Pricing & Acquisition |

Determine the purchase price (par or discount) based on risk and projected return. |

Legal assignment of the note and servicing rights is transferred. |

Directly determines the overall yield and profit. |

|

4. Servicing Setup |

Note is transferred to a third-party licensed servicer. |

Passive Oversight: The servicer handles all collections and compliance. |

Ensures consistent compliance and hands-off collection. |

|

5. Cash Flow or Exit |

Collect payments, modify the loan, or pursue foreclosure if necessary. |

Hands-off income generation and strategy execution. |

Typical 8%–15%+ annual returns. |

Due Diligence: Focus on LTV

In Step 2, a core component is the Loan-to-Value ratio (LTV). This metric shows how much equity is in the property relative to the note’s unpaid principal balance. Professional investors prioritize a low LTV (e.g., 70% or less) to ensure strong collateral value and adequate protection against market decline.

Exit Strategies for Maximum Flexibility

Note investors have multiple ways to realize profit:

Why Investors Choose Mortgage Note Investing

The robust benefits of mortgage note investing make it a preferred choice for sophisticated investors seeking secured, predictable returns.

Every mortgage note is secured by real property. This collateral-backed nature means that if a borrower defaults, the investor has the legal recourse to initiate foreclosure. This tangible security makes notes significantly safer than unsecured debt or stock market equity.

Notes provide steady monthly payments of principal and interest. By outsourcing collections and compliance to a professional servicer, investors create truly passive income without the burdens of tenant management, maintenance, or vacancies associated with rental properties.

Typical annual returns often range from 10% to 12%. Because investors can acquire notes at a discount to the unpaid principal balance, effective yields frequently outperform traditional benchmarks like rentals, bonds, and REITs.

Mortgage notes add stability to investment portfolios by combining the fixed-income characteristics of bonds with the hard asset backing of real estate. The contractual, fixed-income payments help hedge against inflation, while collateralization reduces exposure to general stock market volatility.

Risk Mitigation in Mortgage Note Investing

The primary risk is a borrower default, which interrupts the steady cash flow. However, default does not necessarily result in a loss of principal. The legal recourse to foreclose ensures the investor can eventually recover capital through the collateral. The actual risk is often a delay in the realization of returns.

Mitigation Strategies

Mortgage Notes vs. Traditional Real Estate Strategies

|

Feature |

Mortgage Notes |

Rental Properties |

REITs |

Private Lending |

|

Passive Income |

Yes (Very High) |

Limited (High Management) |

Yes |

Depends on the Deal |

|

Collateral-Backed |

Yes (First Lien Security) |

Yes (Property Owned) |

No Direct Collateral |

Yes, but varies in quality |

|

Typical Returns |

10%–12% |

6%–10% |

3%–6% |

8%–12% |

|

Time Commitment |

Very Low |

High |

Very Low |

Medium |

|

Downside Protection |

High (Foreclosure Rights) |

Medium (Rental Loss Risk) |

Low (Market Dependent) |

Medium (Varies by Borrower) |

How to Start Investing in Mortgage Notes

Mortgage note investing is accessible to various investors depending on capital and expertise.

Mortgage Note Investing FAQs

Is mortgage note investing safe?

Yes. Mortgage notes are secured by real estate collateral. If a default occurs, the investor has legal rights to foreclose and recover the asset, minimizing capital loss risk.

How much money do I need to start investing in mortgage notes?

Minimums vary. Many mortgage note funds and fractional ownership programs begin at $25,000 or less, making the strategy accessible to individual investors.

Can I invest in mortgage notes using my retirement account?

Absolutely. Self-directed IRAs and solo 401(k)s allow investors to hold mortgage notes inside tax-advantaged accounts, maximizing the benefits of the investment.

What kind of returns can I expect?

Typical returns generally range from 10% to 12% annually, though this depends on whether the note is performing, non-performing, and the specific acquisition strategy.

If you’d like to partner with us in our mortgage notes at Capital Funding feel free to send us an email at info@capitalfunding.com or give us a call at 954-320-0242.

Our minimum investment size is $250,000 and certain restrictions and accreditor investor qualifications may apply. *